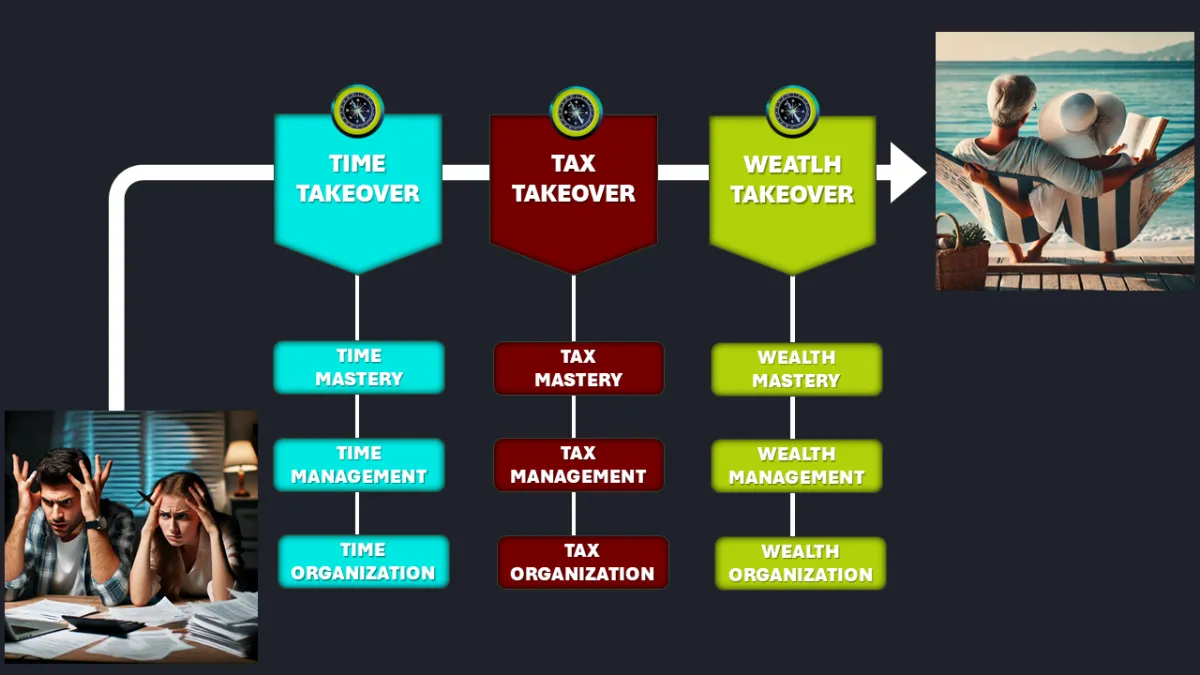

Turbocharge your Time, Tax & Cash Organization Management with Spreadsheets, Faster.

LESS TAX BOOTCAMP

I get it, managing finances is frustrating.

I make it simple & faster

for service-based business owners.

BEFORE

Time, Tax, & Wealth Worry

1. Feeling overwhelmed by taxes, with no clear plan during the year and worry about what could go wrong.

2. Stuck in operation's frustration, wasting hours each week with no system or clarity.

3. Scrambling for last minute tax estimates, always behind, or not knowing your tax bill until tax season.

4. Struggling in conversations with your accountant, feeling like something is missing.

5. Worry if you are losing money every tax season, feeling defenseless.

6. Vulnerable to audits, feeling anxious and unsure if your records are properly organized.

7. Stuck guessing about your finances. No useful easy to use tools to measure or grow your wealth.

AFTER

Time, Tax, & Wealth Organized

1. Turbocharge your Tax Planning using my TCS Quadrant, your secret key to the tax vault.

2. Accelerate the results of your operations with an organized system to supercharge your clarity. Buy back your time!

3. Estimate your taxes on excel 3 months before tax software even hit the market.

4. Revolutionize tax management to transform how you work with your accountant.

5. Defend your cash during tax season using the tax code as your map.

6. Reduce audit risk and speed through one by knowing how to turbo organized your taxes.

7. Have the metrics to track, manage & grow your wealth with simple spreadsheets.

LEARN YEARS' WORTH OF

FINANCIAL ORGANIZATION & IMPLEMENTATION IN JUST 4 FULL DAYS!

LLC TAX TRAINING BOOTCAMP

4-FULL FOCUSED DAYS FOR SERVICE BASED ENTREPRENEURS HONORED TO RECLAIM AUTHORITY & DEFEND THEIR WEALTH.

TIME MASTERY

You will a learn a simplified framework M.A.P to set up or design the success of your business operations faster.

TIME MANAGEMENT

You will see the best way to organize your bookkeeping, business & personal operational digital files to find it faster saving you 10 hours or more per month. Multiply that by your hourly rate.

TIME ORGANIZATION

You will turbo accelerate your results by seeing how your business essential data can easily be organized in an excel spreadsheet to speed your operations with the "Time Cockpit"

TAX MASTERY

If it ever existed a buried secret key to the tax vault,…you found it. After several year in the search, you’ll finally see the tax code the same way the IRS sees it using the power and simplicity of my “TCS Quadrant”.

TAX MANAGEMENT

This is Financial Planning on a Rocket!. Using my “Tax Trove of Tax Strategies”, you will finally be able to create a custom Tax Plan to manage your deductions or expenses efficiently during the year.

TAX ORGANIZATION

What I am about to tell you is not fantasy, it’s the work of several years to make it real. You’ll actually, be able to calculate an estimate of your taxes in October, 3 months before tax software hit the market. Here organization responsibilities vibe on a higher frequency with the “Tax Cockpit”.

WEALTH MASTERY

Accounting is the best friend and love language of every multimillionaire. You will learn a simple method of accounting so you can actually use it. Here you will also become aware of what is “the cash cancer”.

WEALTH MANAGEMENT

You will see a simple tracking system to cancel cash cancer, track your income, expenses, allocations, savings, and the metrics to measure your Net Worth centralized in one place. Your children must also know about this.

WEALTH ORGANIZATION

This is it! You’ll see how your wealth can be meticulously organized in excel to speed your critical Net Worth decisions. There is no results without implementation. You will finally be able to do what 8-figure business owners had to do in order to defend and grow their hard-earned wealth with the "Wealth Cockpit".

4- DAYS FOR THE PRICE OF ALMOST 1- HOUR CONSULTATION

4-DAY LIVE LLC TAX BOOTCAMP

Save the Date

Thu, Fri, Sun & Mon

2025: Aug 21, 22, 24 & 25

8:30 am to 5:00 pm

No class Saturday

Location

Live on Zoom

Link is sent by email

and the

"Tax Takeover Private" Telegram Group

Stop struggling & stop losing money!

REGISTRATION IS NOW OPEN

BOOTCAMP INCLUDES:

1. LLC Tax Takeover Training $9,997

2. Accounting Mastery Training $4,997

3. TIME Management Training $1,997

4. CASH Management Training $2,997

1. Bonus: Lifetime Access to Recordings

2. Bonus: Turbo Excel "Time Cockpit"

3. Bonus: Turbo Excel "Tax Cockpit"

4. Bonus: Turbo Excel "Wealth Cockpit"

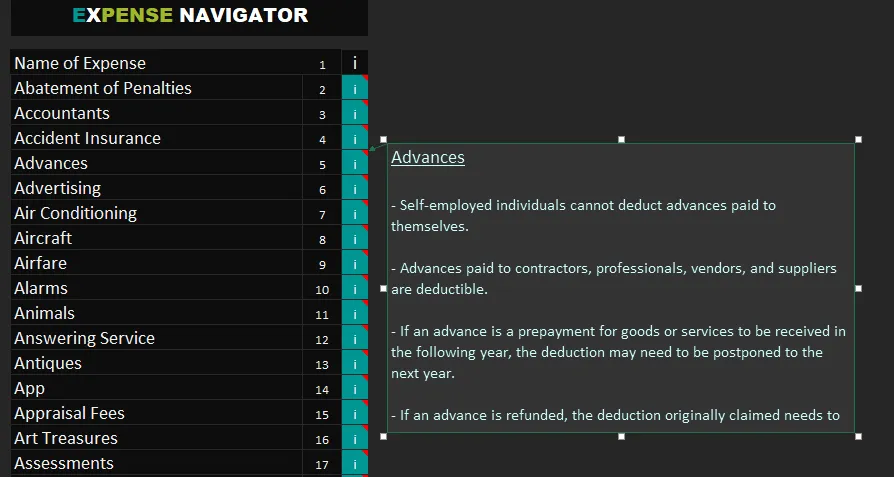

5. Bonus: 200+ Business Deduction Navigator

TOTAL PRICE $19,988

Sale Price $4,997

Limited Time Intro Price

$1,297

Two Ways to Send Your Questions about Registration by Text

ENGLISH: WhatsApp

Send your text with the word in uppercase

"LLC- QUESTION"

689-327-2790

Mon to Fri

9:00 am to 2:00 pm

ESPAÑOL: Telephone

Envíe su texto con la palabra en mayúscula:

'LLC- PREGUNTA.'

407-259-4383

Mon to Fri

9:00 am to 2:00 pm

Guarantee

If for any reason you are not totally satisfied

get 100% of your money back even 2 Days after this LIVE training starts, guarantee!

Why hundreds of business owners have

worked with Susan.

My experience with the process of filing the return with the IRS was a bit frustrating because sometimes I couldn't understand the process. It wasn't until I had the great opportunity to meet and work with Susan Ker. She was kind and patient enough to explain to me what the process consisted of and, most importantly, how to apply my income and my expenses and thus be able to receive a refund or reimbursement. Susan is a skilled professional who knows the A to Z of the tax world. Always willing to look for the best options in your favor. I have a lot to thank you for!

Belisa M.

Human Service Consular

I feel grateful to have worked with Susan Ker. Taxes are something I like to stay away from because it is frustrating. She helped me understand so much. She really is very knowledgeable about taxes, accounting, and organization. It feels great to keep more of my money and know that everything is properly done. Working with Susan is awesome. She is kind and very patient. I felt I could ask any question I had. To me that is important. Thank you, Susan for your easy-to-follow guidance and follow-up. I really appreciate it a lot.

Ruth M.

CFO Business Owner

I've worked with other tax professionals, but I got sick from the frustration. Taxes are a big responsibility, and it can consume a big portion of our time if we let it. Finding Susan Ker was a match in heaven. I actually looked forward to working with her each time we got together. I felt like a big heavy weight was lifted out my back and especially my mind. I learned so much and I got better organized. I am not worried any more if I am overpaying taxes or doing things wrong. I am not worried anymore about my 2 teenagers because I can help them better. Thank you, Susan for helping me save money and keep my sanity.

Rebeca C.

CFO Business Owner

Who is the LLC

Training for?

Ideal for entrepreneurs, contractors, freelancers who sell a service, love spreadsheets, are a dba, single member LLC, or work under their own name.

Example...

Consultants

Course creators

Coaches

Tax Pros

Marketers

Authors

Health Pros

Freelancers

Who is the LLC

Training not for?

This wouldn't be totally ideal for entrepreneurs, contractors, or freelancers who sell a product or merchandise and are foreign residents of another country outside the US.

S-Corp

C-Corps

Multi-member LLC

R.E Investors

Product Based Merchants

Where will this

training happen?

This live Zoom training spans 4 days, with a break of one day in the middle to refresh your mind, review what you've learned, & optimize your questions. This break also helps everyone is on the same journey.

Zoom link shared by email

Also on Telegram "Cash Takeover- Private"

PowerPoint & Excel

Participants are encouraged to turn on their cameras for verbal discussions on Zoom instead of using text chat.

Can I ask questions in Spanish?

Feel free to ask questions in Spanish, and you'll receive answers in Spanish. I also encourage you to register for the LLC Tax Takeover Training given in Spanish!

If you would like to register to the training in Spanish, go to CashTakeover.com/cllc.

PRICELESS BONUSES

THE TRACKER COCKPIT COLLECTION - 3 POWERFUL BUILT FOR YOU SPREADSHEETS

TIME COCKPIT

RESULTS ACCELERATOR

Supercharge your productivity by organizing your projects, goals, and priorities into one streamlined hub.

With tools like a master calendar, action maps, and business timelines, you’ll stay focused and avoid distractions, accelerating results.

Imagine you finally understand how to get financially organized, but then you realize you still need to spend hundreds of hours creating spreadsheets.

Would you do it? Well, not with this training! The TIME COCKPIT system has been meticulously crafted to save you at least 10 hours every month across all areas, freeing up valuable time to focus on growing your business.

ENTREPRENEUR EMPOWERMENT

Empower yourself to lead with clarity and confidence by organizing your team, aligning your mission, and planning your content all in one place.

This will keep you on track to build a business that truly reflects your goals and values.

Now, imagine you’re ready to implement your financial strategy, but creating all the necessary worksheets would take hundreds of hours.

Would you still dive in? With TIME COCKPIT, I’ve already done the hard work, providing you with ready-to-use templates that save you a combined total of 10 hours a month across all areas of business and personal organization.

DIGITAL DATA ORGANIZER

Simplify your operations by keeping everything at your fingertips. From email hubs to file organizers, this tool helps you save time and energy, so you can focus on what really matters.

Picture the stress of getting organized, only to realize you’d need to create all the spreadsheets yourself. Would you commit to that? Not with TIME COCKPIT.

I’ve designed these tools to save you 10+ hours each month in total, giving you back that precious time and mental energy to focus on what truly matters.

Note: Across all three areas—productivity, entrepreneurship, and data organization—the TIME COCKPIT system helps you save a combined total of 10+ hours every month. Multiply that by your hourly rate and imagine how much more you can accomplish with that reclaimed time!

TAX COCKPIT

TAX RECORD ORGANIZATION

Stay ahead of IRS deadlines and avoid costly mistakes with worksheets designed specifically for your business.

Track important item like…your miles, calculate payments, manage home office deductions, manage Sch C deductions and more. This will give you complete control of your finances with full visibility into what’s coming months in advance.

Proper Financial Organization is what helped me speed through in person IRS audits.

TURBO TAX PLANNING

Imagine a Tax Treasure Trove of Strategies at your fingertips, organized so you can pick and choose which one you will use after being able to estimate your tax liabilities in Excel months before the usual tax software hits the market.

The TCS Quadrant allows you to do just that—forecast your federal income tax, self-employment tax, and even the additional Medicare tax long before tax season arrives. You will be empowered to make informed decisions and avoid surprises.

AUDIT PROTECTION

Stay ahead of potential audits with a simple checklist of key warnings. This guide ensures you avoid common mistakes and remain IRS-compliant, giving you peace of mind and confidence in your financial management.

WEALTH COCKPIT

CASH FLOW TACKER

Keep track of both your business and personal income and expenses in one simple spreadsheet. No more jumping between different tools.

You’ll be able to see how fast your cash is moving and keep your accounts balanced, helping you make better financial choices.

SAVINGS TRACKER

Track how much you’re saving for your business and personal goals.

Everything stays in one place, making it easy to see where you’re at and helping you make smarter decisions about your money.

INVESTMENT TRACKER

Keep all your investments and assets in one simple spreadsheet. You can see your returns, track your net worth, and follow your financial growth—all without needing complicated or expensive tools.

These easy-to-use worksheet templates help clear up your mind and make managing your finances simple.

EXTRA BONUS: GET A LIST OF 200+ BUSINESS DEDUCTION NAVIGATOR

Imagine you are in the middle of doing your bookkeeping

or you are about to pay for something and then you are hit with the question... is this expense deductible? or better yet, ...how can I make it deductible? Well, I put together a list of 200+ expenses with tax deduction information on each expense!

If you feel stuck and do not know if an expense is deductible, instead of getting a jungle of information, you can just go straight to that expense navigator in the Tax Cockpit and get the information fast.

This list is separate from the list you already get about what expenses to deduct for each category of your form Sch C.

Frequently Asked Questions

What would I learn in this training?

1.Decode income and tax rates through the lenses of the IRS. You must see what they see to win. Understanding how the IRS operates taxes is critical to conquering their territory.

2.Read your tax bill as you would your grocery bill. You cannot verify or correct your Form 1040 if you cannot discern what is right or wrong. Understanding one of your biggest bills is critical to maintaining control.

Unlock the treasures of tax deductions and credits. These are your weapons. Conquering requires understanding how tax credits and deductions, both above and below the line, really work. This understanding enables you to adjust, manage, and control.

3.Become knowledgeable about critical alerts to lower the risk of an IRS audit. You don’t want to inadvertently provoke an IRS agent or unknowingly trigger an audit.

4.Understand the differences between LLCs and S-Corps for short-term and long-term operations. To optimize the launch & maintenance of your business rocket, you must have a clear understanding of which entity is best for you and how to operate it.

5.Hear the love language of the balance sheet, profit & loss, and cash flow. How do you know if you are winning or losing? Accurately understanding the language of your business is critical to knowing if your business is skyrocketing or if it’s only a matter of time before it crashes. Organization facilitates implementation.

6.Disorder is the perfect plan for losing. Having an organized system for your life, your files, your financials, and people in your network is critical because it increases your revenue altitude, helps pay fewer taxes, helps work confidently with your accountant -- an IRS revenue agent -- or speed through an audit. Time is irreplaceable.

7.Measure the speed and velocity of your cash flow. Imagine, the information you trust helps you make correct or incorrect decisions. You must be equipped to analyze your financials to grow and feel confident about the critical decisions you must make for your business. This will optimize your winnings.

8.Canceling “Cash Cancer” will protect and multiply your wealth. It's not only about winning anymore; it’s also about enjoying your new identity. It’s about maintaining the operations of your business to drastically protect and multiply your cash flow in the long term to have more peace and more time for the things you enjoy as you serve others. It is about leaving a legacy for our families and our next generations.

9.Learning is critical, but implementation is everything. Without proper tools, implementation is always pushed to the side.

10.The turbo spreadsheets you will find in these trainings will secure a proper takeoff from the tax jungle.

Do you process tax forms?

This training does not include processing of tax forms, payroll, tax updates, or bookkeeping. It is designed to equip YOU, the business owner, to revolutionize your approach to managing taxes, cash flow, & time, ultimately transforming how you interact with both the IRS and your accountant.

How will this training be taught?

The training will be taught using zoom. It will be recorded, and the link to the recording will be shared via email within 5 business days after the training. We will use Power Point Slides and Turbo Excel Spreadsheets.

How many times will the training be offered if I decide to purchase it later?

The training is premiering only two times per year, but exceptions may apply.

Who will be teaching the course?

The course will be taught by Susan K. EA and there will be lots of opportunities to ask questions during the day.

Will I get lost in confusing jargon concepts?

No way! The Training is none of that. It is an innovative & exciting approach designed specially for small business owners to say goodbye to financial organization frustration. It has easy actionable advice, colorful images, and spreadsheets to get you ready for some seriously fun and easy implementation!

Will participants receive any other course material?

Yes, apart from the training recordings, students will receive the Turbo Spreadsheets. The Time Cockpit, Tax Cockpit and the Wealth Cockpit.

If I need to take both trainings, can I get a discount?

Yes. If you need both trainings, the LLC Takeover and the S-Corp Takeover, you get 50% discount on the S-Corp Takeover Training when registration opens.

Can I also ask questions in Spanish?

Si. Yo también hablo Español y estoy Feliz de responder tu pregunta en Español. Yes. I also speak Spanish and I am super happy to answer your questions in Spanish.

What happens if the training is not for me after I buy it?

No worries at all. If for any reason you are not completely satisfied after you buy it or after you attend the live training, you can get a full 100% refund up to the guarantee seal show on this page. Currently the first 48 hour of starting the training. How crazy is that for a live bootcamp?

Because I know the pain of tax frustration, my heart commitment is to ensure I go above and beyond the call of duty to massively over deliver. You deserve the best so you can give your best.

I have more questions; how do I communicate with you?

I would love to chat live with you to get to know you, hear your comments, and answer any questions you may have about the 4-day LLC Tax Training.

1) During early bird Registration, please visit cashtakeover.com to make an appt, or

2) send your question by text to 407-588-8855 with the word in upper case QUESTION (only text because as you can imagine, this number gets massive ads) or

3) attend to one of my live YouTube sessions during tax season or

4) join my Facebook group at https://www.facebook.com/share/g/19W4VUjqAj/ or

5) join my free telegram channel "Cash Takeover free" https://t.me/+AOz0ALAWZrxiMjdh

My Friend Entrepreneur,

Are you a service-based business owner feeling overwhelmed by taxes and accounting? Does the thought of an audit stress you out? Does your accountant's advice sound like a foreign language?

I get it. It's hard!

You're working tirelessly to grow your business, but taxes feel like an extra burden. Deep down, you worry: What if I get audited? How can I stay organized? Is there a better way to pay less in taxes?

With over 13 years of experience helping businesses from zero to eight figures, I've developed a secret weapon: the TCS Quadrant. It's the key to unlocking the tax code vault, and it's about to change everything for you.

Imagine waking up on a Sunday in October, feeling excited and in control. Your finances are organized, your tax estimate is ready months before software hits the market, and you already have a tax plan of action, you're feeling calm.

This isn't a fantasy – it's what awaits you after our 4-day LLC Takeover bootcamp.

In just four focused days, you'll gain years of tax mastery, management, and organization. You'll go from frustrated taxpayer to financial authority, ready to protect your wealth on your terms.

Curious? Watch my free video to see the truth for yourself.

If you're ready to extinguish your financial frustrations and skyrocket your cash flow, click the green button below to join us for the 4-Day LLC Takeover and take back control of your financial future.

Sometimes dreams do become a reality, today is your turn.

Can't wait to guide you on this transformative journey!

Susan Ker, EA.

IRS Enrolled Agent & Financial Coach

Regardless of culture or language, I envision a TAKEOVER of Cash Flow and True Peace using the

Superpowers of Tax and Accounting Organization.

Gained 11 years of financial and team support experience in the banking industry, managing tellers and bankers.

Founded my Tax & Accounting Practice in 2008.

Achieved enrollment as an IRS Enrolled Agent and Certified QuickBooks Pro Advisor.

Represented 5 to 8 figure business owners in in-person audits with the Internal Revenue Service and a state agency, saving them thousands of dollars and reducing audit processing time by at least 50% through strategic tax organization.

Delivered tax savings education at various realtor offices for several years.

Assisted hundreds of entrepreneurs with personal, LLC, S-Corp, and C-Corp tax returns, payroll, representation, tax & accounting trainings, and financial organization.

I sold my practice to better serve business owners with lasting solutions that are 100 times more efficient. I am learning from the top mentor, God and top entrepreneurs like Brendon Burchard, Dave Ramsey, Keith Cunningham, Anthony Robbins, John Maxwell, Grant Cardone and Eileen Wilder. This allowed me to fully dedicate myself to creating unique training programs. Now, I can speed the process to help you reduce taxes and organize your finances with a more powerful and transformative approach.

Established the Cash Takeover Trainings, offering one-on-one and group support.

Now it's your chance to decrease tax anxiety and achieve financial peace ... faster.

Dear Friend, from my heart to yours,

THANK YOU

Applauses for you for being the SUPERHERO

your business needs you to be to make your efforts & time... count.

Disclaimer:

The information provided in this training is based on extensive professional research in the fields of tax and accounting. However, we do not guarantee any specific results, including your ability to achieve financial success or save money using our strategies. Your outcomes will depend entirely on your own time, effort, energy, and commitment. Success in business requires a solid plan, a strong work ethic, and perseverance through challenges.

This training is designed to give you a sample of our comprehensive offerings. All relevant information is detailed in our terms, privacy policies, and disclaimers, accessible via the links on this page. If you understand and appreciate this common-sense approach to business and recognize that achieving meaningful goals requires dedication and effort, we believe you are a perfect fit for our program, and we look forward to helping you succeed. Enjoy the training!